Will a Silver Tsunami Change the 2024 Housing Market?

Have you ever heard the term “Silver Tsunami” and wondered what it’s all about? If so, that might be because there’s been lot of talk about it online recently. Let’s dive into what it is and why it won’t drastically impact the housing market.

What Does Silver Tsunami Mean?

A recent article from HousingWire calls it:

“. . . a colloquialism referring to aging Americans changing their housing arrangements to accommodate aging . . .”

The thought is that as baby boomers grow older, a significant number will start downsizing their homes. Considering how large that generation is, if these moves happened in a big wave, it would affect the housing market by causing a significant uptick in the number of larger homes for sale. That influx of homes coming onto the market would impact the balance of supply and demand and more.

The concept makes sense in theory, but will it happen? And if so, when?

Why It Won’t Have a Huge Impact on the Housing Market in 2024

Experts say, so far, a silver tsunami hasn’t happened – and it probably won’t anytime soon. According to that same article from HousingWire:

“. . . the silver tsunami’s transformative potential for the U.S. housing market has not yet materialized in any meaningful way, and few expect it to anytime soon.”

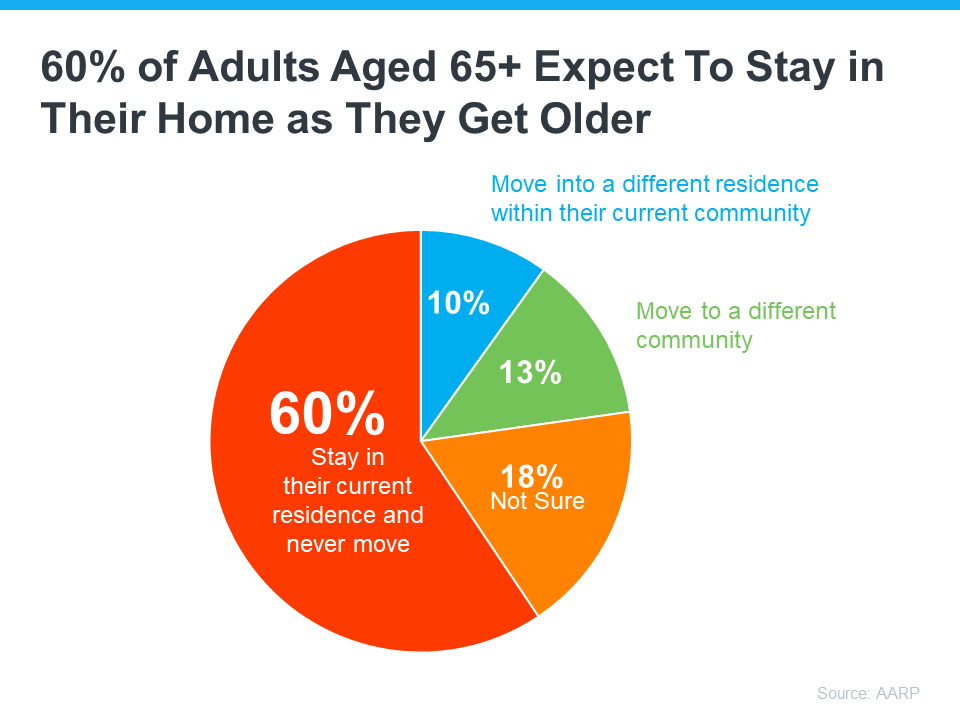

Here’s just one reason why. Many baby boomers don’t want to move. Data from the AARP shows over half of the surveyed adults ages 65 and up plan to stay put and age in place in their current home rather than move (see chart below):

Clearly, not every baby boomer is planning to sell or move – and even those who do won’t do it all at once. Instead, it will be more gradual, happening slowly over time. As Mark Fleming, Chief Economist at First American, says:

“Demographics are never a tsunami. The baby boomer generation is almost two decades of births. That means they’re going to take about two decades to work their way through.”

Bottom Line

If you’re worried about a Silver Tsunami shaking up the housing market, don’t be. Any impact from baby boomers moving will be gradual over many years. Fleming sums it up best:

“Demographic trends, they don’t tsunami. They trickle.”

3 Must-Do’s When Selling Your House in 2024

If one of the goals on your list is selling your house and making a move this year, you’re likely juggling a mix of excitement about what’s ahead and feeling a little sentimental about your current home.

A great way to balance those emotions and make sure you’re confident in your decision is to keep these three best practices in mind when you’re ready to sell.

1. Price Your Home Right

The housing market shifted in 2023 as mortgage rates rose and home price appreciation started to normalize once again. As a seller, you still need to recognize how important it is to price your house appropriately based on where the market is today. Hannah Jones, Economic Research Analyst for Realtor.com, explains:

“Sellers need to become familiar with their local market and work closely with a local agent to make sure their listing is attractive to buyers. Buyers feeling the pressure of affordability are likely to be pickier, so a well-priced, well-maintained home is the ticket to drumming up big demand.”

If you price your house too high, you run the risk of deterring buyers. And if you go too low, you’re leaving money on the table. An experienced real estate agent can help determine what your ideal asking price should be, so your house moves quickly and for top dollar.

2. Keep Your Emotions in Check

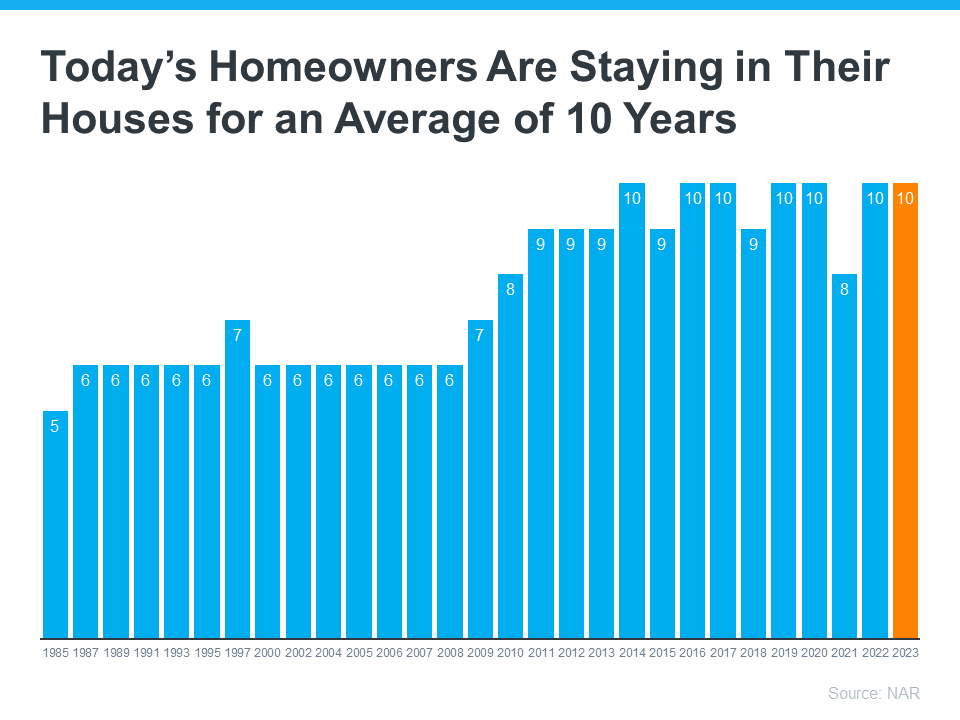

Today, homeowners are staying in their houses longer than they used to. According to the National Association of Realtors (NAR), since 1985, the average time a homeowner has owned their home has increased from 6 to 10 years (see graph below):

This is much more than what used to be the norm. The side effect, however, is when you stay in one place for so long, you may get even more emotionally attached to your space. If it’s the first home you bought or the house where your loved ones grew up, it very likely means something extra special to you. Every room has memories, and it’s hard to detach from the sentimental value.

For some homeowners, that makes it even tougher to separate the emotional value of the house from fair market price. That’s why you need a real estate professional to help you with the negotiations and the best pricing strategy along the way. Trust the professionals who have your best interests in mind.

3. Stage Your Home Properly

While you may love your decor and how you’ve customized your house over the years, not all buyers will feel the same way about your vibe. That’s why it’s so important to make sure you focus on your home’s first impression, so it appeals to as many buyers as possible.

Buyers want to be able to picture themselves in the home. They need to see themselves inside with their furniture and keepsakes – not your pictures and decorations. As Jessica Lautz, Deputy Chief Economist and Vice President of Research at NAR, says:

“Buyers want to easily envision themselves within a new home and home staging is a way to showcase the property in its best light.”

A real estate professional can help you with expertise on getting your house ready to sell.

Bottom Line

If you’re considering selling your house, reach out to a local real estate professional to help you navigate the process while prioritizing these must-do’s.

Why You May Want To Seriously Consider a Newly Built Home

Are you putting off your plans to sell because you’re worried you won’t be able to find a home you like when you move? If so, it may be time to consider a newly built home and the benefits that come with one. Here’s why.

Near-Record Percentage of New Home Inventory

Newly built homes are becoming an increasingly significant part of today’s housing inventory. According to the most recent report from the National Association of Home Builders (NAHB):

“Newly built homes available for sale accounted for 31% of total homes available for sale in November, compared to an approximate 12% historical average.”

That means the percentage of the total homes available to buy that are newly built is well over two times higher than the norm. And even more new homes are on the way.

Recent data from the Census shows there’s been an uptick in both housing starts (where builders break ground on more new homes) and housing completions (homes where construction just wrapped).

And while some people may worry builders are building too many homes, that isn’t a concern – if anything, the recent increase is really good news. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Even more home building will be needed with the housing shortage persisting in most markets . . . Another 30% rise in home construction can easily be absorbed in the marketplace . . .”

How This Helps You

Since the supply of existing homes for sale is still low right now, the increase of new-home construction can be a game changer because it gives you more options for your search.

Picture yourself in a home that’s new from the ground up: new appliances, fresh paint, fewer maintenance needs because everything is new, and so much more. Doesn’t that sound nice?

And it may be more within reach than you ever imagined. In addition, some builders are offering things like mortgage rate buy-downs for homebuyers right now. This can help offset today’s affordability challenges while also getting you into your dream home. In a recent article, Patrick Duffy, Senior Real Estate Economist at U.S. News, explains:

“Builders have been using mortgage interest rate buydowns for many years as a sales incentive whenever interest rates are relatively high, . . .Today more builders are offering rate buydowns for the entirety of the loan, allowing buyers to finance more home for the same payment amount.”

Just remember, the process of buying from a builder is different from buying from a home seller, so it’s important to partner with a trusted real estate agent who knows the local market. They’ll be your go-to resource for coordinating with the builder, reviewing contracts, and more.

Bottom Line

If you’re trying to sell so you can make a move but you’re having a hard time finding a home you like, let’s connect. That way you have a local expert to help you explore all of your options, including the newly built homes in our area.

Why Now Is Still a Great Time To Sell Your House

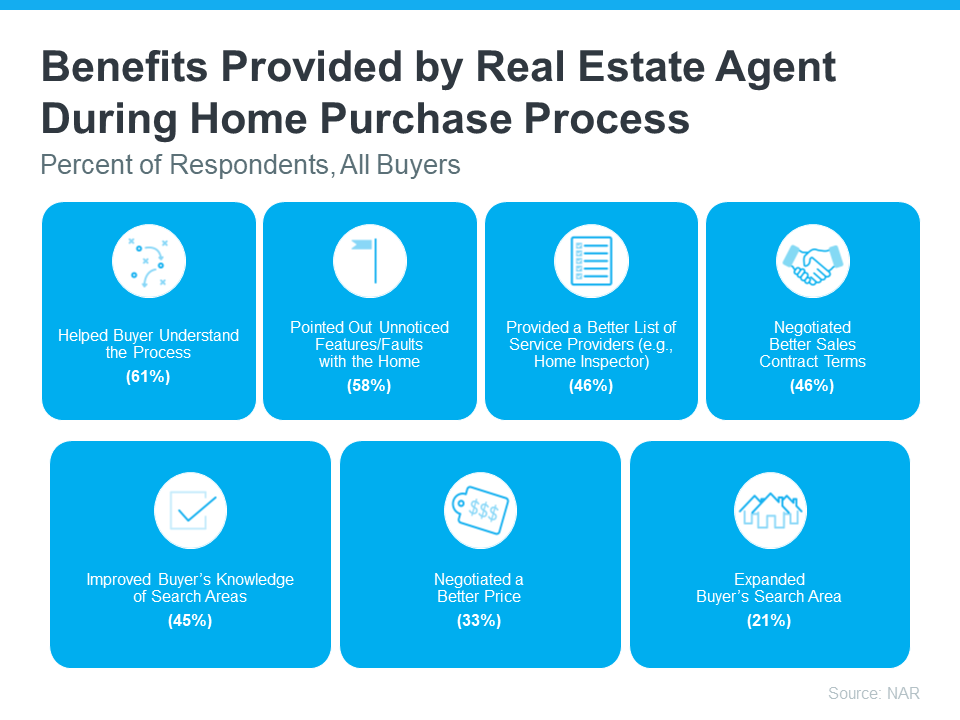

If you were worried buyer demand disappeared when mortgage rates went up, the data shows there are plenty of interested buyers still out there. The housing market isn’t as frenzied as it was during the ‘unicorn’ years when buyer demand was through the roof, mortgage rates were historically low, and home values rose like we’ve never seen before. But that doesn’t mean the market is at a standstill.

Nationally, demand is still high compared to the last normal years in the housing market and plenty of buyers are making moves right now. Here’s the data to prove it.

Showing Traffic Is Up

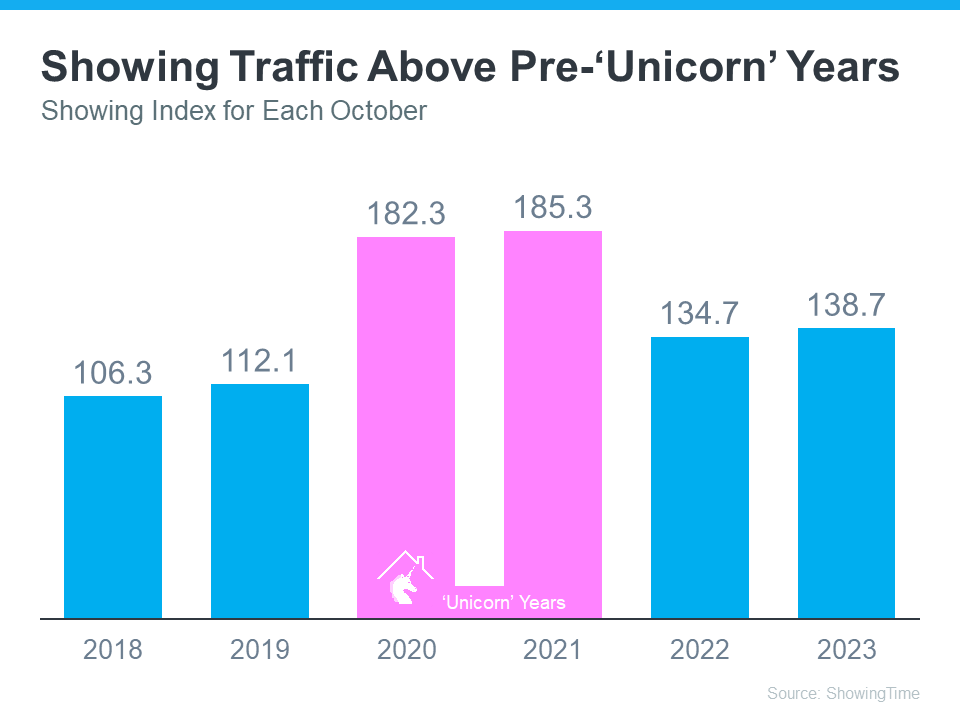

The ShowingTime Showing Index is a measure of how frequently buyers are touring homes. The graph below uses that index to show buyer activity over the past eight Octobers:

In the graph, the ‘unicorn’ years are shown in pink. You can see demand has dipped some since then. That’s in response to higher mortgage rates. But, when you compare 2023 to the blue bars on the left that represent the last normal years in the market (2018-2019), you can tell buyers are still more active than the norm.

But showing traffic isn’t the only way to see buyer demand is still high. The number of offers other sellers are getting and the average days homes are on the market tell the same story.

Sellers Are Still Seeing Multiple Offers

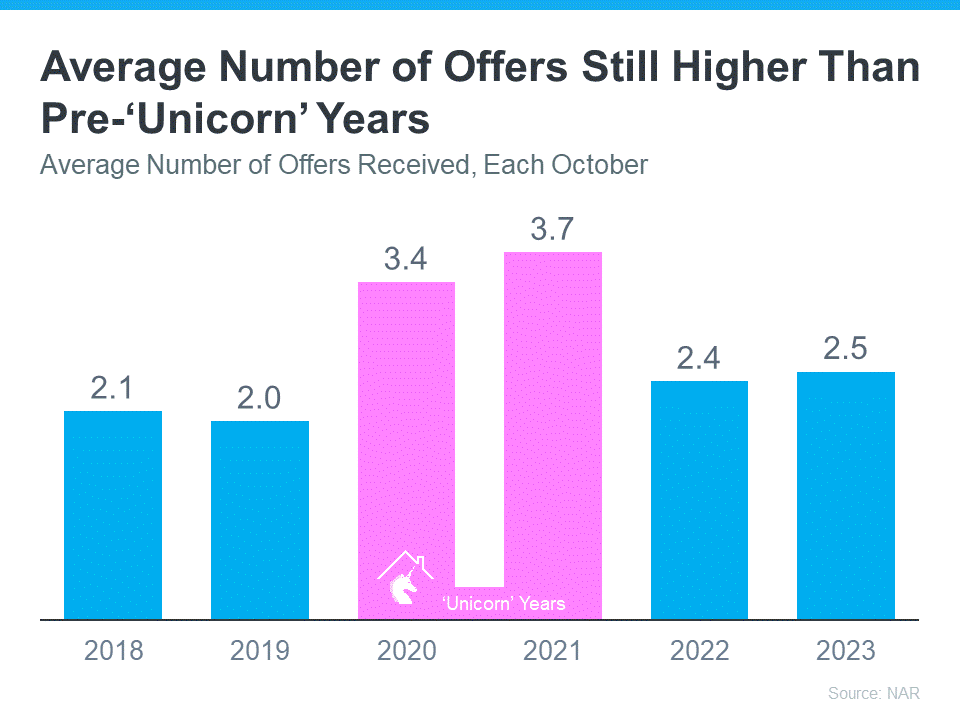

According to the latest data from the National Association of Realtors (NAR), sellers are receiving an average of 2.5 offers on their houses. Let’s look at how that compares to recent years (see graph below):

It’s true that’s fewer than the number of offers sellers were receiving during the ‘unicorn’ years (shown in pink). But compared to last year, the number is up slightly. And it’s higher than it was in the more normal, pre-‘unicorn’ years in the housing market too.

Homes Priced Right Are Selling Fast

And it’s not just that sellers are still typically getting multiple offers more than the norm, they’re also seeing their homes sell fast. That’s a direct result of strong buyer demand. According to Zillow:

“. . . low inventory levels are spurring surprisingly strong competition . . . demand has remained resilient, and attractive, appropriately priced listings are moving quickly.”

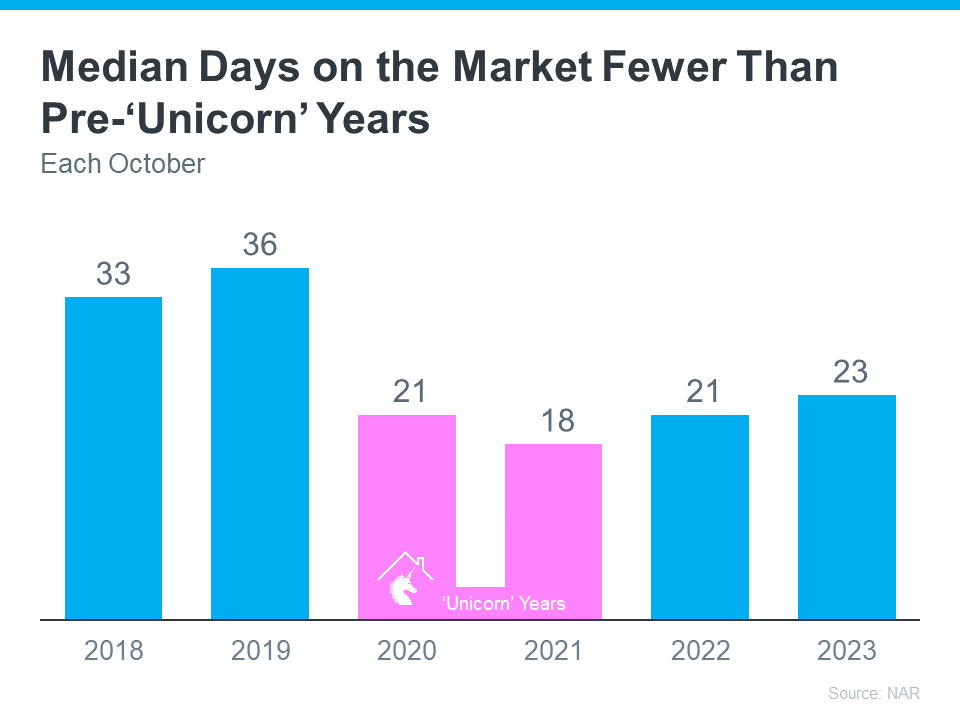

To help showcase that homes for sale are still going quickly, let’s look at data from NAR on the median days on market for this same time of year from 2018 through now (see graph below):

As the graph shows, this year homes are sitting on the market only slightly longer than they were during the frenzy of the ‘unicorn’ years. And compared to the last normal years in the market, homes are still selling much faster than they did back then. That’s good news for sellers because it means there are eager buyers out there right now.

Bottom Line

You haven’t missed your chance to sell at a time when sellers are receiving multiple offers, and homes are selling fast. When you’re ready to sell your house, connect with a local real estate agent to get the ball rolling.

When You Sell Your House, Where Do You Plan To Go?

If you’re thinking about selling your house, you may have heard the supply of homes for sale is still low, and that means your house should stand out to buyers who are craving more options. But you may also be wondering, once you sell, how does the current supply impact your own move? And, will you be able to find a home you want to buy with inventory this low?

One thing that can help you find your next home is exploring all your options, including both homes that have been lived in before as well as newly built ones. Let’s look at the benefits of each one.

The Pros of Newly Built Homes

First, let’s look at the advantages of purchasing a newly constructed home. With a brand-new home, you’ll be able to:

- Create your perfect home. If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more.

- Cash-in on energy efficiency. When building a home, you can choose energy-efficient options to help lower your utility costs and reduce your carbon footprint.

- Minimize the need for repairs. Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little projects to tackle.

- Have brand new everything. Another perk of a new home is that nothing in the house is used. It’s all brand new and uniquely yours from day one.

The Pros of Existing Homes

Now, let’s compare that to the perks that come with buying an existing home. With a pre-existing home, you can:

- Explore a wider variety of home styles and floorplans. With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

- Join an established neighborhood. Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit.

- Enjoy mature trees and landscaping. Established neighborhoods also have more developed landscaping and trees, which can give you additional privacy and curb appeal.

- Appreciate that lived-in charm. The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home.

The choice is yours. When you start your search for the perfect home, remember that you can go either route – you just need to decide which features and benefits are most important to you. As an article from The Mortgage Reports says:

“When building, you gain more freedom to tailor the design, materials, and features, but it demands more time and involvement. Conversely, buying an established home offers immediate occupancy . . . yet may require compromises. Your choice should align with your budget, timeline, customization preferences, and the local real estate landscape.”

Either way, working with a local real estate agent throughout the process is mission-critical to your success. They’ll help you explore all of your options based on what matters most to you in your next home. Together, you can find the home that’s right for you.

Bottom Line

If you have questions about the options in your area, connect with a local real estate agent to discuss what’s available and what’s right for you. That way you’ll be ready to make your next move with confidence.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

This time every year, homeowners who are planning to move have a decision to make: sell now or wait until after the holidays. Some sellers with homes already on the market may even remove their listing until the new year.

But the truth is, many buyers want to purchase a home for the holidays, and your house might be just what they’re looking for. As an article from Fortune Builders explains:

“ . . . while a majority of people take a step back from the real estate market during the holiday months, you may find when the temperature drops, your potential for a great real estate deal starts to rise.”

To help prove that point, here are four reasons you shouldn’t wait to sell your house.

1. The desire to own a home doesn’t stop during the holidays. While a few buyers might opt to delay their moving plans until January, others may need to move now because something in their life has changed. The buyers who look for homes at this time of year are usually motivated to make their move happen and are eager to buy. A recent article from Investopedia says:

“Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer. Putting your home on the market at this time of year and attracting a serious buyer can often result in a quicker sale.”

2. While the supply of homes for sale has increased a little bit lately, overall inventory is still lower than it was before the pandemic. What does that mean for you? If you work with an agent to price your house at market value, it could still sell quickly because today’s buyers are craving more options – and your home may be exactly what they’re searching for.

3. You can determine the days and times that are most convenient for you for home showings. That can help you minimize disruptions to your own schedule, which can be especially important during this busy time of year. Plus, you may find buyers are more flexible on when they’ll tour a house this time of year because they have more time off from work around the holidays.

4. And finally, homes decorated for the holidays appeal to many buyers. For those buyers, it’s easy to picture gathering with their loved ones in the home and making memories of their own. An article on selling at this time of year offers this advice:

“If you’re selling around a holiday and have decorations up, make sure they accent—not overpower—a room. Less is more.”

Bottom Line

There are plenty of good reasons to put your house on the market during the holiday season. Connect with a real estate agent and see if it’s the right time for you to sell.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link