Why Selling Your House This Winter Gives You an Edge

Spring gets all the attention, but it’s not always the best time to sell a house. Yes, more buyers show up, but so do a lot of other sellers.

Winter is different. With fewer homes on the market, your house has a much better chance of standing out. And that one advantage can make a big difference.

Winter Is When Your Listing Stands Out

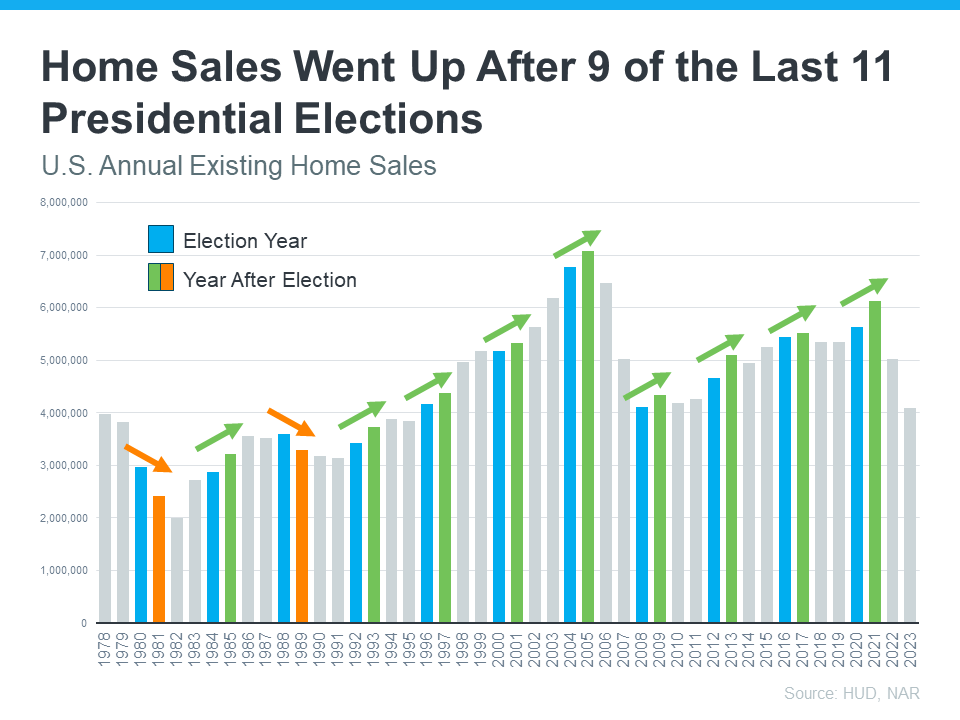

History shows the number of homes for sale tends to drop during the winter months. It’s a trend that’s predictable almost every year.

Data from Realtor.com shows this pattern clearly. Inventory dips in the winter (the green circles in the graph below), then climbs again as soon as spring approaches:

And based on the latest data available, it looks like that pattern may be true again in 2025. The graph shows the supply of homes for sale is starting to come down as we head into the end of the year. And if history is any indicator of where it goes next, it’ll continue to fall just like it usually does.

And based on the latest data available, it looks like that pattern may be true again in 2025. The graph shows the supply of homes for sale is starting to come down as we head into the end of the year. And if history is any indicator of where it goes next, it’ll continue to fall just like it usually does.

Here’s why knowing this gives you an edge.

While inventory is higher now than it’s been in the last few years, there are still not as many homes for sale as there’d be in a normal market (2017-2019). And we may even be poised for inventory to dip a bit as the weather cools.

That gives you an opportunity. If you work with an agent to list now, you’ll sell while other homeowners are taking their homes off the market and before the number of homes for sale climbs this spring.

Less competition from other sellers now = more attention on your house this season.

Why wait until everyone else lists in the spring when you can get ahead of the crowd?

Winter Buyers Are Serious Buyers

Another big perk is the buyers looking right now usually need to move.

They’re not just browsing for fun. They’re relocating for work, dealing with a lease ending, making a big life change, or simply ready to move forward sooner rather than later. As U.S. News explains:

“. . . buyers who are trudging through wintry weather often have a good reason for being out in the cold – they need to move. Whether it’s a relocation for a new job, a divorce or the arrival of a new baby, buyers who brave the elements are usually serious and able to make quick decisions.”

That means fewer weekend wanderers and more highly motivated, qualified buyers walking through your door.

And since we know inventory usually drops this time of year, odds are they’ll have a little less to choose from compared to the fall. If you price and prep your house right, maybe your house will be the one that catches their eye.

Bottom Line

Winter might not get the same buzz as spring, but that’s exactly why it works in your favor. Less competition from other sellers, more motivated buyers, and a chance for your house to truly stand out.

If you’re thinking about selling, this season can give you a real advantage. Let’s connect and talk through what listing now could look like for you.

How Much Does It Cost To Sell My House?

If you’re toying with the idea of selling your house, you’re probably wondering how much it’ll cost. To be honest, the final number will depend on several factors like the offer you accept, if you help with your buyer’s closing costs, how many repairs you tackle, and more.

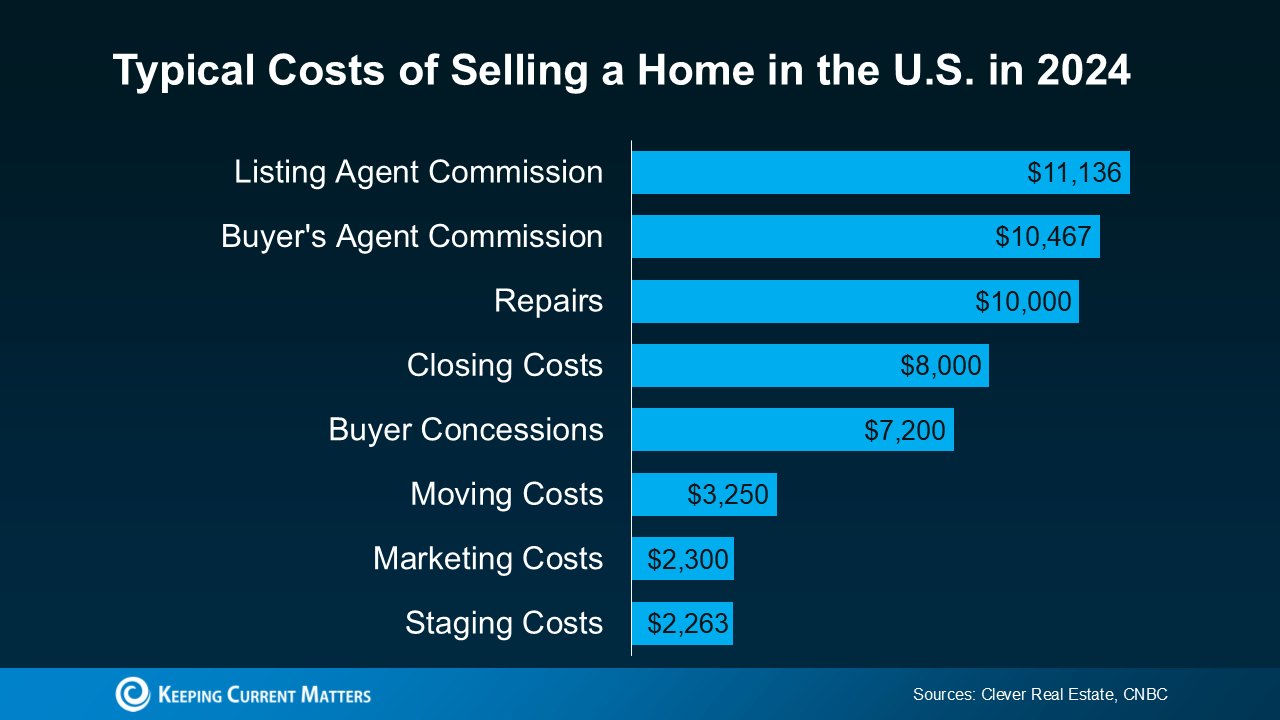

So, to give you a ballpark of what to expect, here’s some information on a few of the expenses you’ll want to be ready for (see graph below):

But here’s something that puts those costs into perspective. Most homeowners today have a substantial amount of equity built up in their homes, and that means they stand to make significant gains when they sell. Chances are, you do too. This can help quickly recoup these selling costs. You may even have enough equity leftover to put some toward your next home purchase too.

But here’s something that puts those costs into perspective. Most homeowners today have a substantial amount of equity built up in their homes, and that means they stand to make significant gains when they sell. Chances are, you do too. This can help quickly recoup these selling costs. You may even have enough equity leftover to put some toward your next home purchase too.

Let’s dive into a few of the costs from the graph above, so you have a bit more context on what they include and where you may be able to save some money, when it makes sense.

Closing Costs and Commission

These are the fees you’ll pay at the closing table to cover various aspects of the sale. You’ll have your own closing costs and you may even offer to pay some of the buyer’s as a concession. As U.S. News Real Estate explains:

“Closing costs are fees that are paid to finalize the transaction and transfer ownership of the home to the buyer . . . Sellers can expect to pay 2% to 4% of the sale price of the home in fees and taxes on top of the agent commission. Based on the national median home sale price, this means that closing costs in 2023 for sellers are about $7,740 to $15,480. . .”

Taxes are going to vary by state and agent commissions depend on what you agree upon upfront. And keep in mind, that the numbers in the chart above are just an example, not exact figures. Not to mention, if you put money toward things like your property taxes, mortgage escrow, etc. as part of your current mortgage payments – there’s a chance you’ll get a credit back at closing that can help offset some of these selling expenses.

Pre-Listing Inspection and Repairs

One optional step some sellers take is having a pre-listing inspection. It gives you an idea of what may pop up later on in the buyer’s inspection – because those are the items a buyer may ask you to toss in a credit (or concession) to cover later on.

This allows you to get a jump on any repairs and tackle them before you list, so your house is set up to impress from the start.

Again, if you want to skip this step, an agent can help. They’ll be able to give you advice on things like paint colors, small cosmetic repairs, what buyers are looking for, and whether it’s worth tackling anything else ahead of time. This will help make sure you’re spending money on things that are most likely to net you a solid return on your investment.

Home Staging

As inventory grows, you may want to take a few extra steps to make sure your house stands out. Staging is an optional way to make sure your house shows well. It can include bringing in rental furniture if the house is vacant or art to warm up the walls. Some staging can even be done virtually once the photos are taken. But, in general, how much does it cost? According to Bankrate:

“Home sellers typically pay somewhere between $782 and $2,817 in home staging costs . . . but the price tag can vary widely.”

If you want to skip this step, you could opt to lean on your agent’s advice for what looks good and what may feel cluttered. A great agent will suggest things like removing a chair to open up the flow of a room, laying down a rug to add warmth to a space, or taking down photographs to de-personalize strategic areas.

Why Leaning on an Agent Is Key

If you’re looking to cut down on your costs, you have options. But be careful of where you trim. You may be able to skip staging or a pre-listing inspection since those are optional, but you don’t want to skimp and sell without a pro.

An agent is your go-to expert throughout the transaction. They’ll offer customized advice every step of the way, including how to stage the house and what repairs to tackle. This can help you avoid hiring an outside stager or having to pay for a pre-listing inspection.

But that’s not the only way your agent adds value. They’ll also create tailored marketing and pricing strategies that’ll highlight the house’s best assets and any work you did to get the home show ready. And that can actually help your house sell for more in the long run.

Bottom Line

Want a better picture of what you should expect when you sell your house? Have a conversation with a local real estate agent.

Where Will You Go After You Sell?

If you’re planning to sell your house and move, you probably know there’s been a shortage of options available. But here’s the good news: the supply of homes for sale has grown in a lot of markets this year – and that’s not just existing, or previously-owned, homes. It’s true for newly built homes too.

So how do you decide which route to go? Do you buy an existing home or a brand-new one? The choice is yours – you just need to figure out what’s most important to you.

Perks of a Newly Built Home

Here are some benefits of buying a newly built home right now:

- Have brand new everything with never-been-used appliances and materials

- Use energy efficient options to save money and leave a smaller footprint

- Minimize the need for repairs and benefit from builder warranties

- Take advantage of builder concessions that can help with affordability

In today’s market, a lot of builders are focusing on selling their current inventory before they add more homes to their mix. And some of them are offering concessions and are more willing to negotiate to make a sale happen.

That, coupled with the fact builders are primarily building smaller, more affordable homes, has led to one other potential perk. The median price for a newly built home in today’s market is actually lower than the median price of an existing home – which isn’t usually the case. Ralph McLaughlin, Senior Economist at Realtor.com, shares:

“Homebuyers who are looking for that ‘new-home smell’ may be in a relatively friendlier market than times past when new homes were considerably more expensive than used ones.”

If you’re interested in seeing what builders nearby have to offer, lean on your real estate agent. Their knowledge of local builders, new communities, and builder contracts will be important in this process.

Perks of an Existing Home

Now, let’s compare that to the benefits of buying an existing home.

- Join an established neighborhood that you can get a feel for before moving in

- Choose from a wider variety of floorplans and styles

- Appreciate the lived-in charm that only an older home can provide

- Enjoy the privacy and curb appeal of mature trees and landscaping

In addition to these lifestyle benefits, there’s strategic value to buying an existing home, too. Remember, you can always make upgrades to an existing home down the road to give it some of the latest features available. This gives you the best of both worlds: you’ll get the charm, the neighborhood, and over time, you can still add those on-trend elements you may see in a brand-new home. And if you do, you’ll likely increase the home’s value too. An article from LendingTree explains:

“. . . they can personalize it and possibly increase its potential resale value with cosmetic upgrades . . . Plus, if a home comes with physical details or stories that add charm, in some cases, these elements are attractive enough to add to a home’s resale value . . .”

Want to see what’s available? Your real estate agent can show you what homes are for sale in your area, so you can see if there’s one that works for you and your needs.

Bottom Line

There are a lot of factors that go into deciding whether to buy an existing home or a newly built one after you sell, but it’s essential in today’s market to understand the opportunities you can find in both. Work with a local housing market professional so you have expert guidance as you explore the options in your area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link