3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in 2008. But the good news is, there’s concrete data to show why this is nothing like the last time.

There’s Still a Shortage of Homes on the Market Today, Not a Surplus

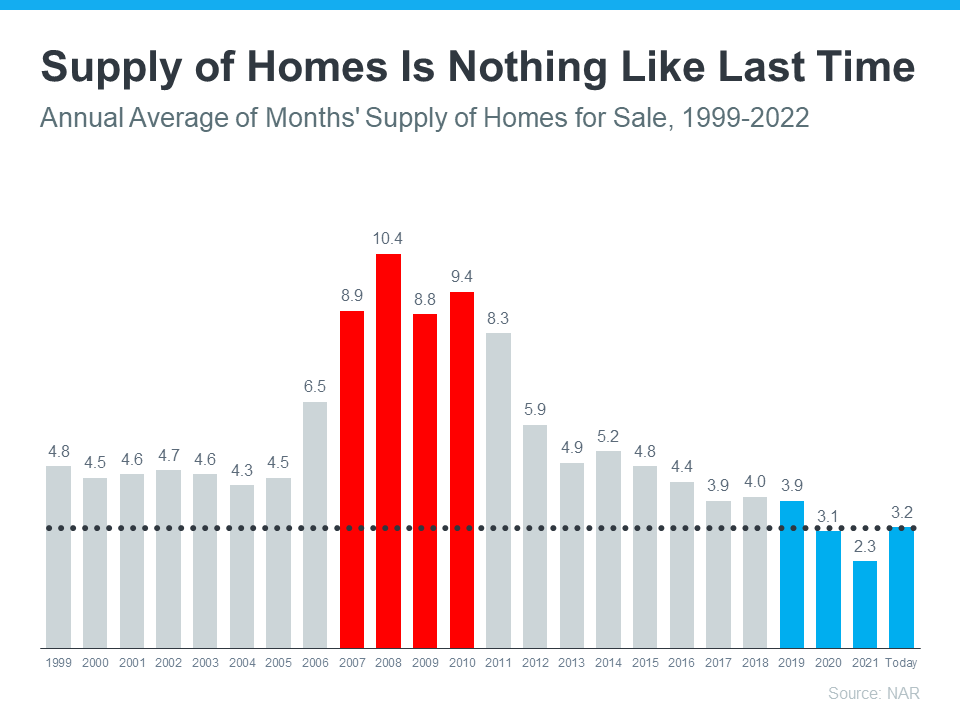

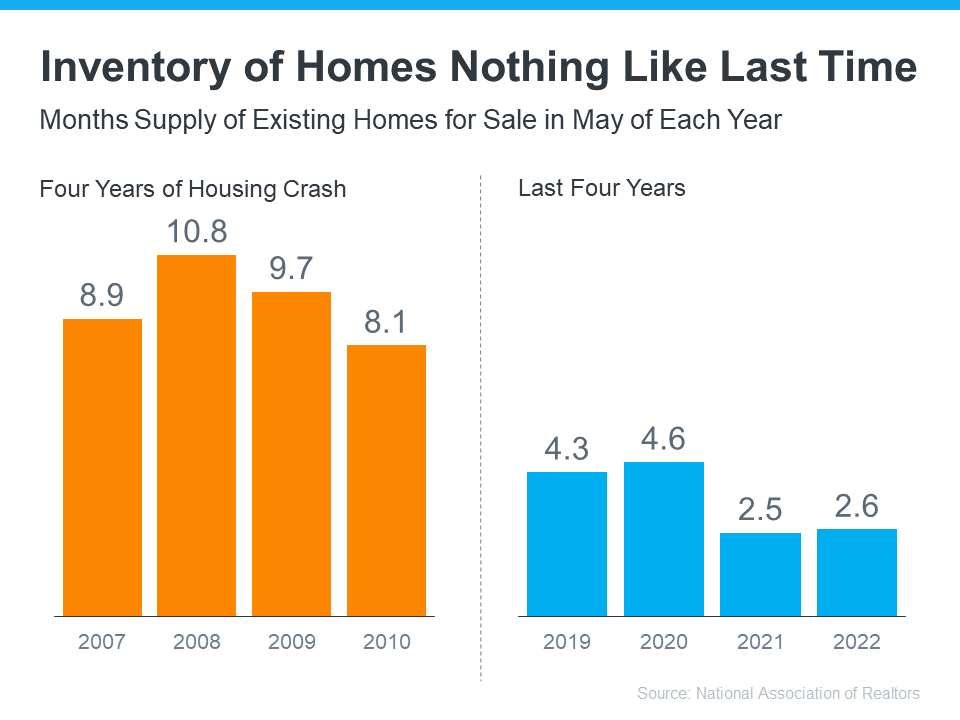

For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to almost 15 years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 3.2-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines.

Mortgage Standards Were Much More Relaxed Back Then

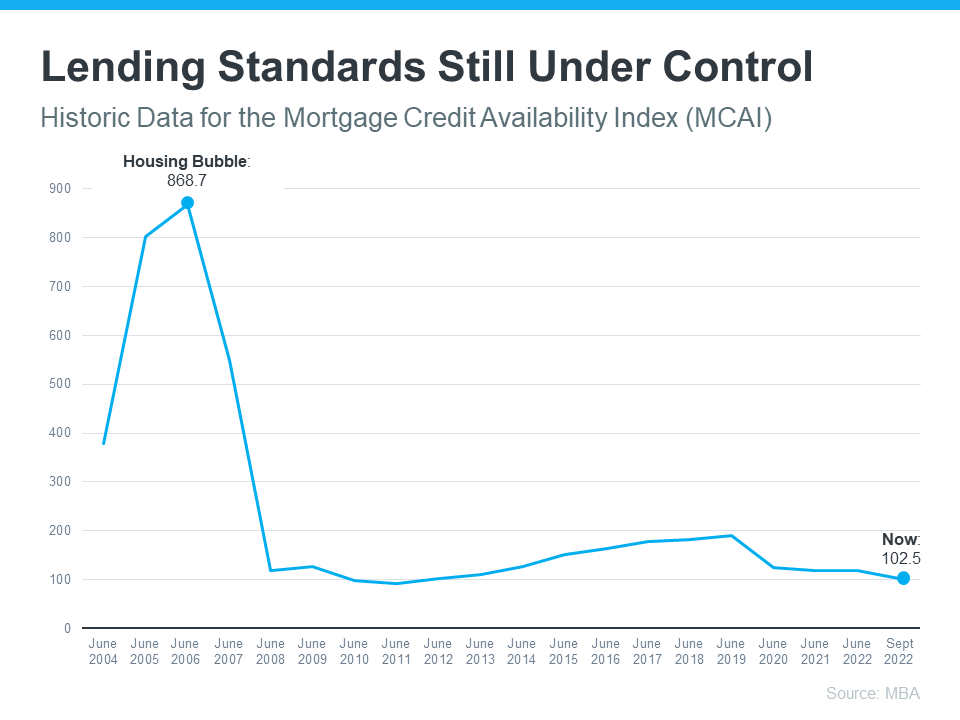

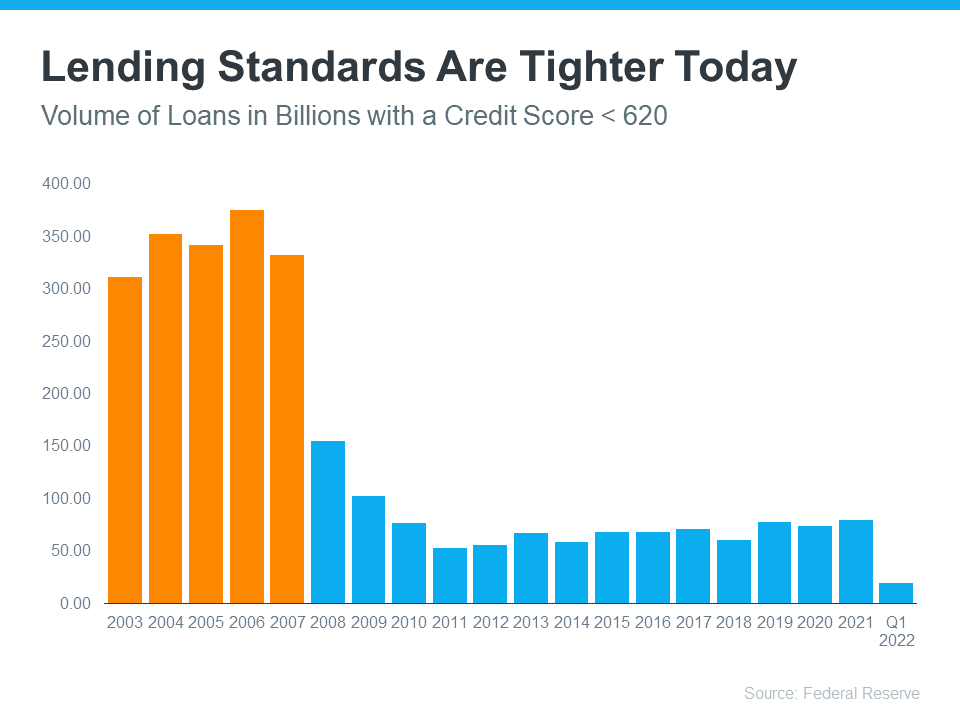

During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home.

Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies.

The graph below uses Mortgage Credit Availability Index (MCAI) data from the Mortgage Bankers Association (MBA) to help tell this story. In that index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is. In the latest report, the index fell by 5.4%, indicating standards are tightening.

This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards over the past 14 years have helped prevent a scenario that would lead to a wave of foreclosures like the last time.

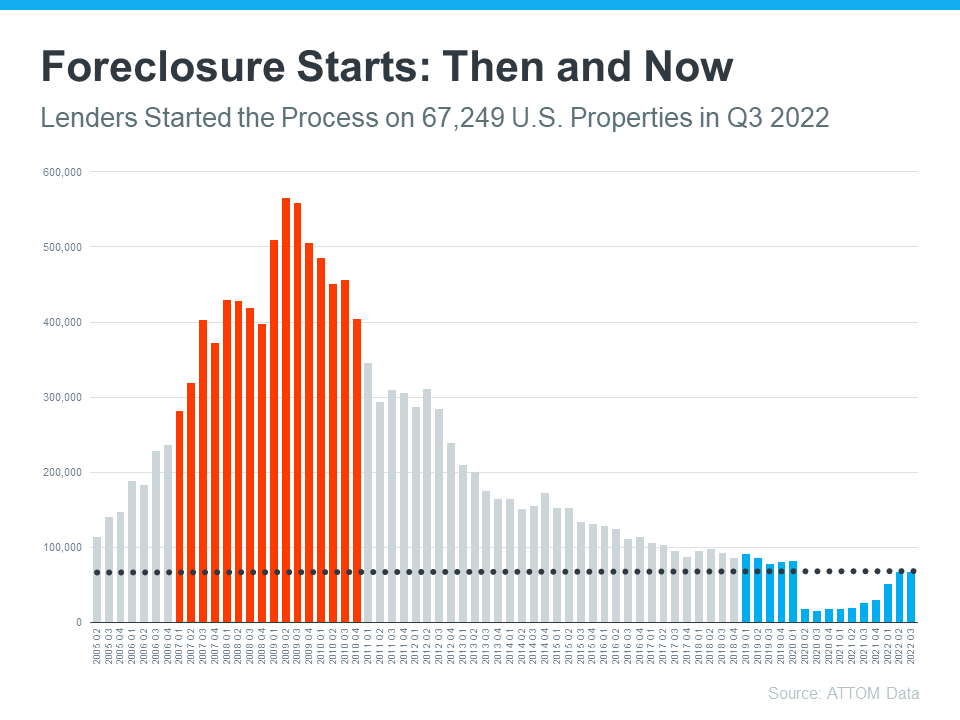

The Foreclosure Volume Is Nothing Like It Was During the Crash

Another difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help paint the picture of how different things are this time:

Not to mention, homeowners today have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Today, many homeowners are equity rich. That equity comes, in large part, from the way home prices have appreciated over time. According to CoreLogic:

“The total average equity per borrower has now reached almost $300,000, the highest in the data series.”

Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains the impact this has:

“Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. . . . We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.”

This goes to show homeowners are in a completely different position this time. For those facing challenges today, many have the option to use their equity to sell their house and avoid the foreclosure process.

Bottom Line

If you’re concerned we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your fears. Concrete data and expert insights clearly show why this is nothing like the last time.

What’s Ahead for Home Prices?

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely to happen moving forward?

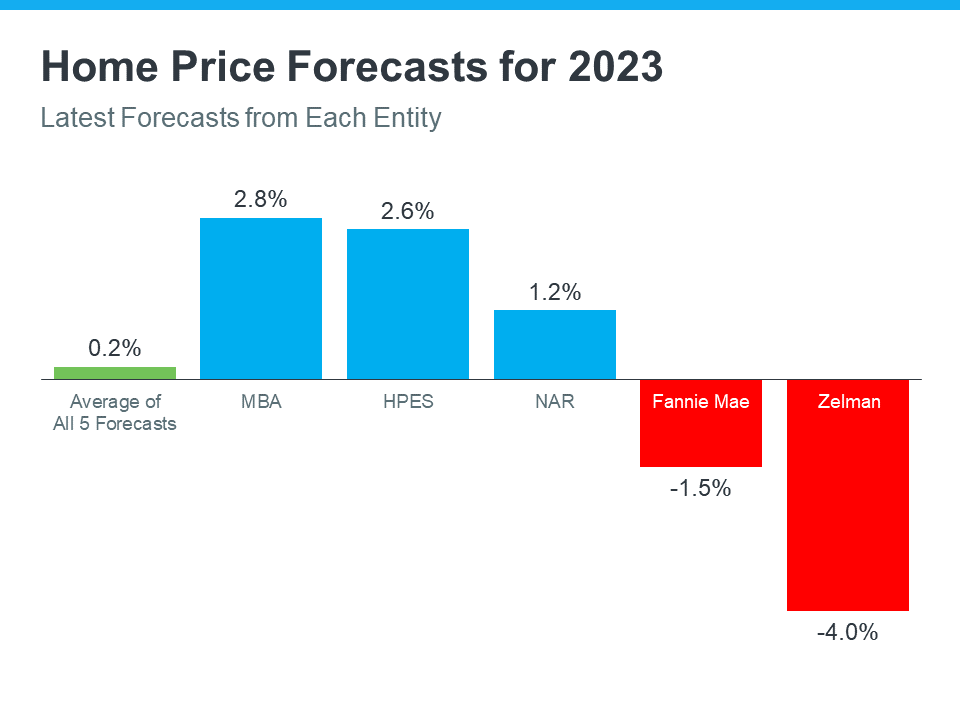

While opinions differ, the most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation. Here’s a look at the latest expert projections so you have the best information possible today.

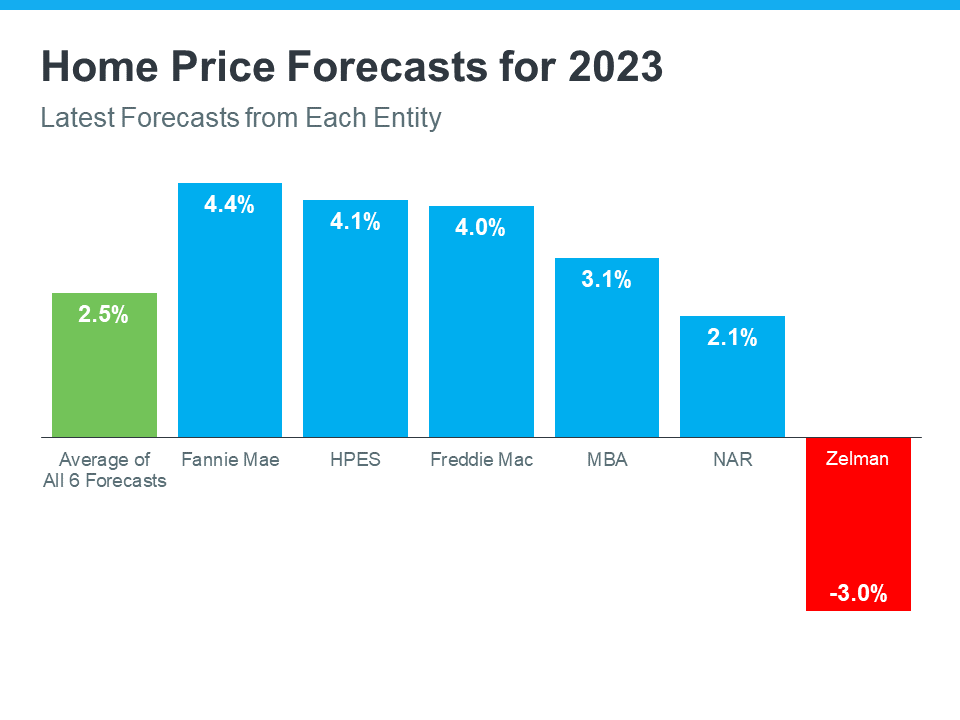

What the Experts Are Saying About Home Prices Next Year

The graph below shows the most up-to-date forecasts from five experts in the housing industry. These are the experts that have most recently updated their projections based on current market trends:

As the graph shows, the three blue bars represent experts calling for ongoing home price appreciation, just at a more moderate rate than recent years. The red bars on the graph are experts calling for home price depreciation.

While there isn’t a clear consensus, if you take the average (shown in green) of all five of these forecasts, the most likely outcome is, nationally, home price appreciation will be fairly flat next year.

What Does This Mean?

Basically, experts are divided on what’s ahead for 2023. Home prices will likely depreciate slightly in some markets and will continue to gain ground in others. It all depends on the conditions in your local market, like how overheated that market was in recent years, current inventory levels, buyer demand, and more.

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices will fall in 2023, they think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

As Jason Lewris, Co-Founder and Chief Data Officer for Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

Don’t let fear or uncertainty change your plans. If you’re unsure about where prices are headed or how to make sense of what’s going on in today’s housing market, reach out to a local real estate professional for the guidance you need each step of the way.

Bottom Line

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted real estate professional to help you make confident and informed decisions about what’s happening in our market.

How To Prep Your House for Sale This Fall

Today’s housing market is different than it was just a few months ago. And if you’re thinking about selling your house, that may leave you wondering what you need to do differently as a result. The answer is simple. Taking the time upfront to prep your house appropriately and create a solid plan can help bring in the greatest return on your investment.

Here are a few simple tips to make sure you maximize the sale of your house this fall.

1. Price It Right

One of the first things buyers will notice is the price of your house. That’s because the price sends a message to home shoppers. Pricing your house too high to begin with could put you at a disadvantage by discouraging buyers from making an offer. On the flip side, pricing your house too low may make buyers worry there’s some underlying issue or something wrong with the home.

Your goal in pricing your house is to gain the attention of prospective buyers and get them to make an offer. And with price growth and buyer demand moderating, as well as a greater supply of homes available for sale, pricing your home appropriately for where the market is today has become more important than ever before.

But how do you know that perfect number? Pricing your house isn’t a guessing game. It takes skill and expertise. Work with a trusted real estate advisor to determine the current market value for your home.

2. Keep It Clean

It may sound simple but keeping your house clean is another key to making sure it gets the attention it deserves. As realtor.com says in the Home Selling Checklist:

“When selling your home, it’s important to keep everything tidy for buyers, and you never know when a buyer is going to want to schedule a last-minute tour.”

Before each buyer visits, assess your space and determine what needs your attention. Wash the dishes, make the beds, and put away any clutter. Doing these simple things can reduce potential distractions for buyers.

For more tips, check out this checklist for preparing your house for sale. Ultimately an agent is your best resource for tailored advice, but this list can help get you started.

3. Help Buyers Feel at Home

Finally, it’s important for buyers to see all the possible ways they can make your house their next home. An easy first step to create this blank canvas is removing personal items, like pictures, awards, and sentimental belongings. It’s also a good idea to remove any excess furniture to help the rooms feel bigger and make sure there’s ample space for touring buyers to stand and look at the layout.

If you’re unsure what should be packed away and what can stay, consult your trusted real estate advisor. Spending the time on this step can pay off in the long run. As a recent article from the National Association of Realtors (NAR) explains:

“Staging is the art of preparing a home to appeal to the greatest number of potential buyers in your market. The right arrangements can move you into a higher price-point and help buyers fall in love the moment they walk through the door.”

Bottom Line

Selling a house requires prep work and expertise. If you’re looking to sell your house this season, let’s connect so you have advice on how to get it ready to list, how to help it stand out in today’s shifting market, and more.

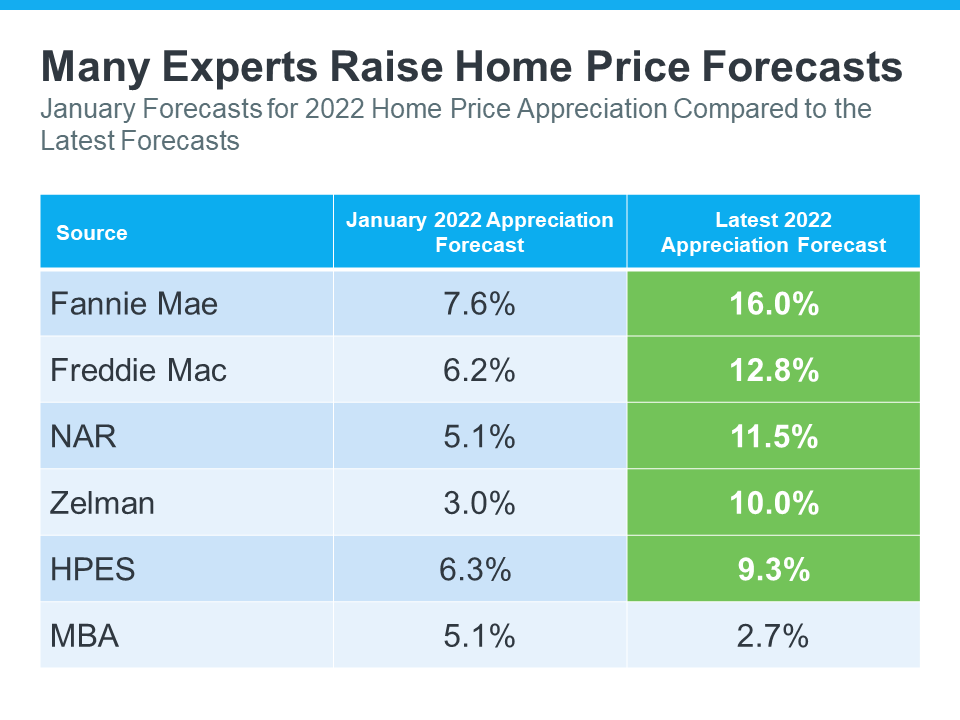

Experts Increase 2022 Home Price Projections

If you’re wondering if home prices are going to come down due to the cooldown in the housing market or a potential recession, here’s what you need to know. Not only are experts forecasting home prices will continue to appreciate nationwide this year, but most of them also actually increased their projections for home price appreciation from their original 2022 forecasts (shown in green in the chart below):

As the chart shows, most sources adjusted up, and now call for more appreciation in 2022 than they originally projected this January. But why are experts so confident the housing market will see ongoing appreciation? It’s because of supply and demand in most markets. As Bankrate says:

As the chart shows, most sources adjusted up, and now call for more appreciation in 2022 than they originally projected this January. But why are experts so confident the housing market will see ongoing appreciation? It’s because of supply and demand in most markets. As Bankrate says:

“After all, supplies of homes for sale remain near record lows. And while a jump in mortgage rates has dampened demand somewhat, demand still outpaces supply, thanks to a combination of little new construction and strong household formation by large numbers of millennials.”

Knowing that experts forecast home prices will continue to appreciate in most markets and that they’ve actually increased their original projections for this year should help you answer the question: will home prices fall? According to the latest forecasts, experts are confident prices will continue to appreciate this year, although at a more moderate rate than they did in 2021.

Bottom Line

If you’re worried home prices are going to decline, rest assured many experts raised their forecasts to say they’ll continue to appreciate in most markets this year. If you have questions about what’s happening with home prices in our local area, let’s connect.

Two Reasons Why Today’s Housing Market Isn’t a Bubble

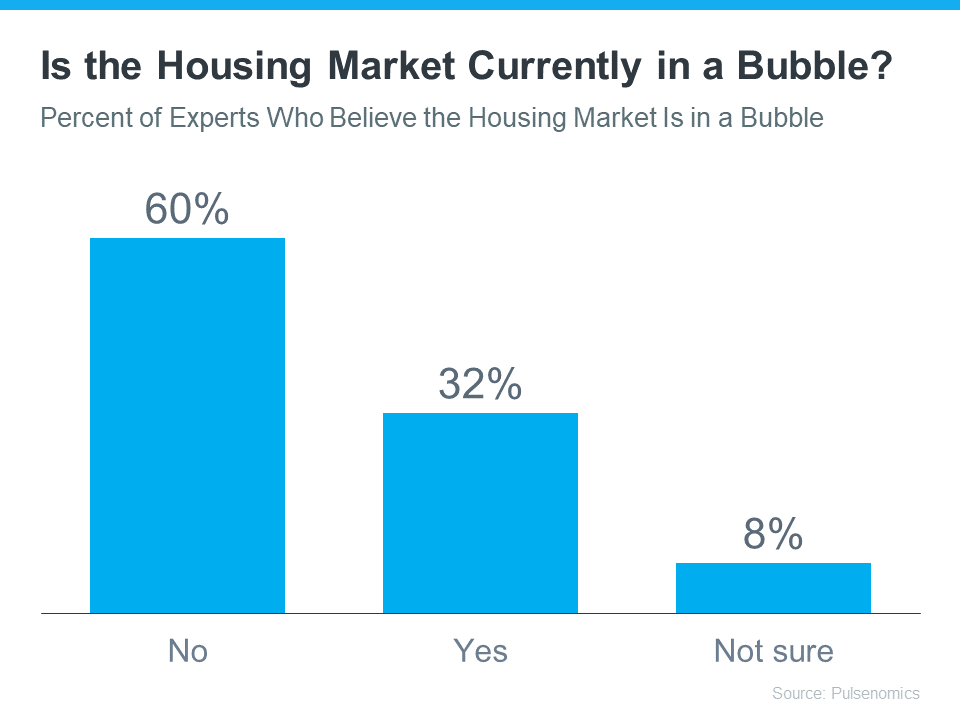

You may be reading headlines and hearing talk about a potential housing bubble or a crash, but it’s important to understand that the data and expert opinions tell a different story. A recent survey from Pulsenomics asked over one hundred housing market experts and real estate economists if they believe the housing market is in a bubble. The results indicate most experts don’t think that’s the case (see graph below):

As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. In the same survey, experts give the following reasons why this isn’t like 2008:

As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. In the same survey, experts give the following reasons why this isn’t like 2008:

- The recent growth in home prices is because of demographics and low inventory

- Credit risks are low because underwriting and lending standards are sound

If you’re concerned a crash may be coming, here’s a deep dive into those two key factors that should help ease your concerns.

1. Low Housing Inventory Is Causing Home Prices To Rise

The supply of homes available for sale needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation.

As the graph below shows, there were too many homes for sale from 2007 to 2010 (many of which were short sales and foreclosures), and that caused prices to tumble. Today, there’s still a shortage of inventory, which is causing ongoing home price appreciation (see graph below):

Inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a limited supply of homes for sale. Odeta Kushi, Deputy Chief Economist at First American, explains:

Inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a limited supply of homes for sale. Odeta Kushi, Deputy Chief Economist at First American, explains:

“The fundamentals driving house price growth in the U.S. remain intact. . . . The demand for homes continues to exceed the supply of homes for sale, which is keeping house price growth high.”

2. Mortgage Lending Standards Today Are Nothing Like the Last Time

During the housing bubble, it was much easier to get a mortgage than it is today. Here’s a graph showing the mortgage volume issued to purchasers with a credit score less than 620 during the housing boom, and the subsequent volume in the years after:

This graph helps show one element of why mortgage standards are nothing like they were the last time. Purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Realtor.com notes:

This graph helps show one element of why mortgage standards are nothing like they were the last time. Purchasers who acquired a mortgage over the last decade are much more qualified than they were in the years leading up to the crash. Realtor.com notes:

“. . . Lenders are giving mortgages only to the most qualified borrowers. These buyers are less likely to wind up in foreclosure.”

Bottom Line

A majority of experts agree we’re not in a housing bubble. That’s because home price growth is backed by strong housing market fundamentals and lending standards are much tighter today. If you have questions, let’s connect to discuss why today’s housing market is nothing like 2008.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link